Are you tired of feeling like you’re stuck between a rock and a hard place when it comes to your retirement savings? You want to use your 401(k) funds for a big purchase or to pay off debt, but the thought of triggering an early withdrawal penalty keeps you up at night. Well, fear not! You’re about to uncover a valuable exception that can help you navigate this conundrum.

Understanding the 401k Early Withdrawal Penalty Exception

In today’s fast-paced world, it’s not uncommon for unexpected expenses or financial emergencies to arise. Whether it’s a home repair, medical bill, or other unforeseen expense, it’s crucial to know that there is a way to access your retirement funds without incurring penalties. In this post, we’ll delve into the 401(k) early withdrawal penalty exception and explore its benefits.

What is the 401k Early Withdrawal Penalty Exception?

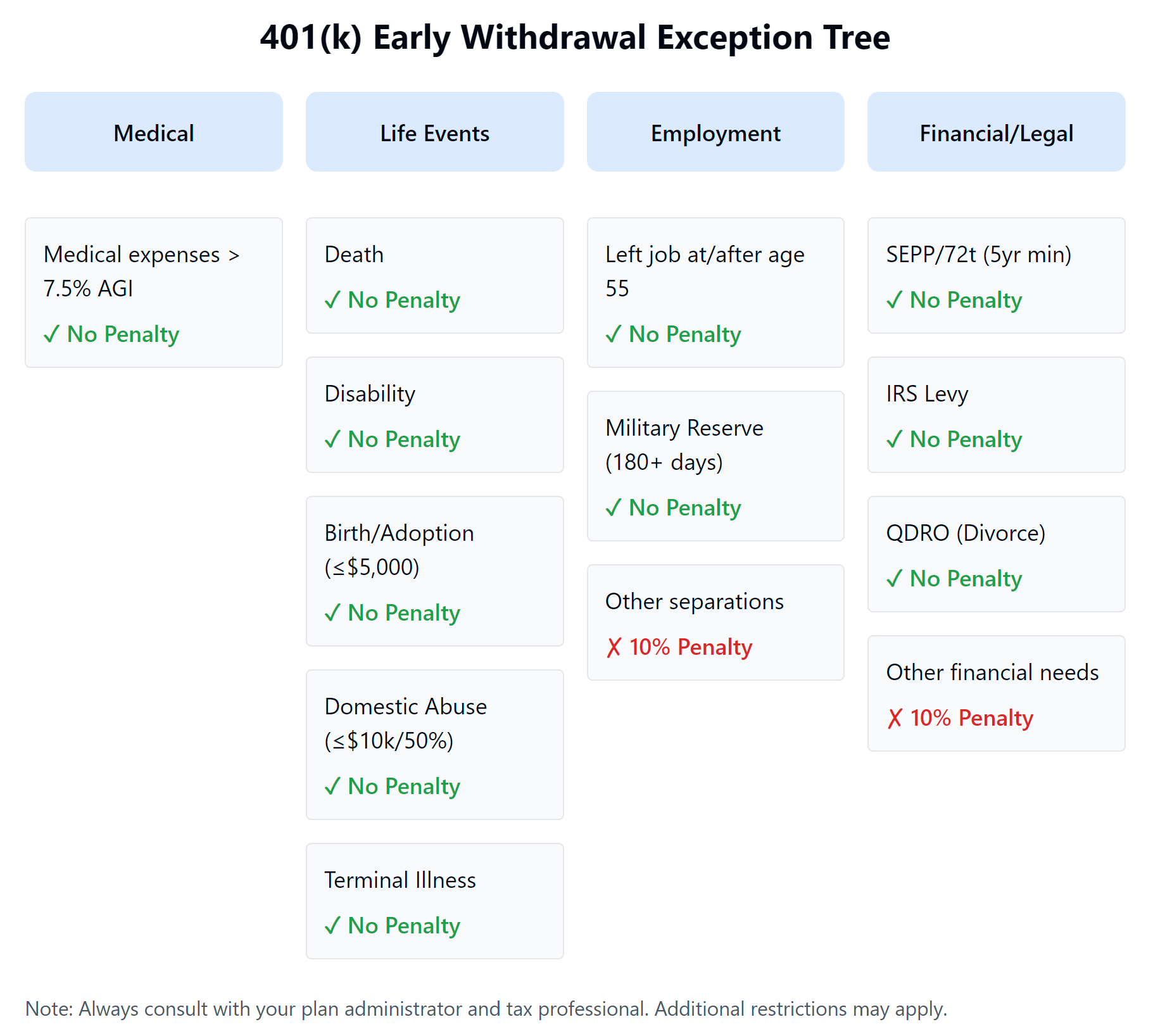

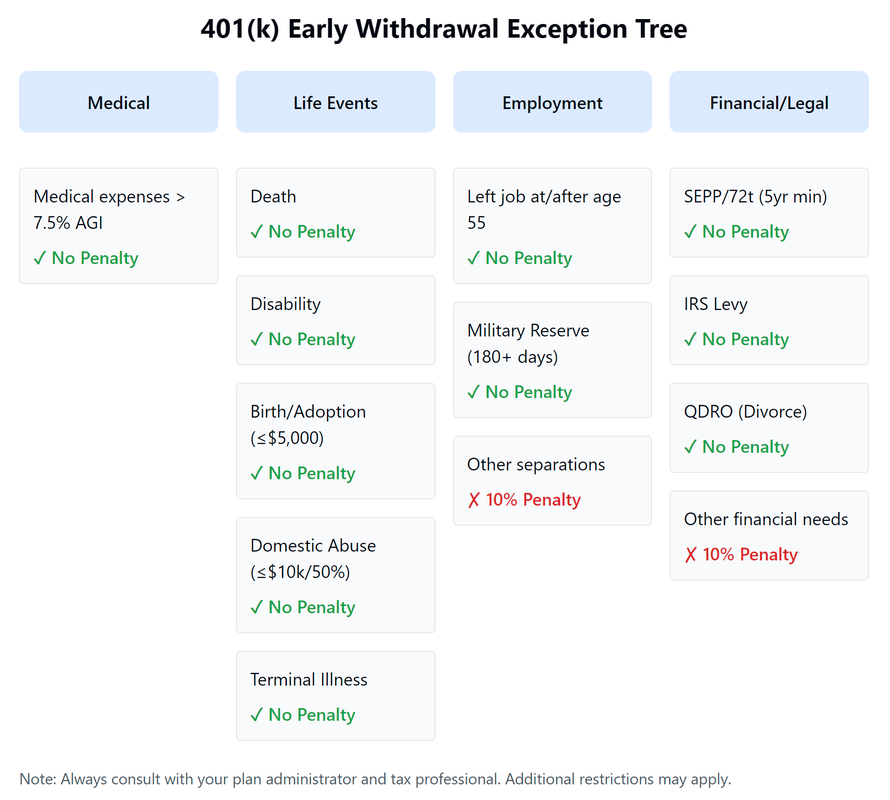

The IRS allows certain exceptions for withdrawing from a 401(k) plan before age 59 1/2 without incurring a 10% penalty. One such exception is the “separation from service” rule, which applies to individuals who leave their employer or retire. When you separate from your job, you can withdraw your retirement funds without facing the early withdrawal penalty.

This exception can be especially helpful for those nearing retirement age or experiencing a significant change in their career. By understanding how this rule works and what it means for your financial situation, you’ll be better equipped to make informed decisions about your retirement savings.

Now that we’ve covered the basics of the separation from service exception, let’s dive deeper into the details and explore some key takeaways.

What Qualifies as Separation from Service?

The IRS defines separation from service as leaving your employer or retiring. This includes instances where you:

- Quit your job

- Get laid off

- Retire due to age, health, or other reasons

- Take a leave of absence that results in the end of your employment

When you meet these criteria, you’re eligible to withdraw your 401(k) funds without incurring the early withdrawal penalty. It’s essential to note that this exception only applies to the actual separation from service event, not to subsequent events like a divorce or inheritance.

Example Scenarios

To better illustrate how this exception works, let’s consider two example scenarios:

- Sarah, 55, decides to retire after working for her current employer for 30 years. She can withdraw her entire 401(k) balance without penalty.

- John, 62, gets laid off due to company restructuring. He’s eligible to withdraw his 401(k) funds without penalty, as he’s separated from service.

In both cases, Sarah and John are exempt from the early withdrawal penalty because they’ve met the separation from service criteria. This exception can provide financial relief during challenging times, allowing individuals to access their retirement savings without incurring unnecessary penalties.

Conclusion

We’ve covered the essential details of the 401(k) early withdrawal penalty exception and explored its application in various scenarios. As you navigate your own financial journey, it’s crucial to understand how this rule can benefit you. In our next section, we’ll delve into other exceptions that may apply to your retirement savings. Stay tuned!

For more information on the 401(k) early withdrawal penalty exception and other retirement-related topics, consider visiting the IRS website. Additionally, consult with a financial advisor or tax professional for personalized guidance.

Expert Financial Guidance

Get expert advice on managing your finances and retirement planning.

Start chatIn summary, understanding the 401(k) early withdrawal penalty exception can provide significant relief for individuals facing unexpected expenses or financial emergencies. As we’ve explored, the “separation from service” rule allows for penalty-free withdrawals when separating from an employer or retiring.

Final Insights

Avoiding unnecessary penalties on your retirement savings is crucial to achieving long-term financial goals. By knowing when and how to access your funds without incurring a 10% penalty, you’ll be better equipped to make informed decisions about your financial future.

Conclusion

In conclusion, the 401(k) early withdrawal penalty exception offers a lifeline for those facing unexpected expenses or financial emergencies. By understanding the “separation from service” rule and its benefits, you’ll be empowered to make smart financial decisions that align with your goals and values. Remember, having access to your retirement funds without penalties can be a game-changer in times of need. So take control of your financial future and explore the 401(k) early withdrawal penalty exception today!

2 Week Old Puppy a Bloated Condition?: Is your new furry friend struggling with digestive issues? Learn what causes bloating in puppies and how to alleviate symptoms. From recognizing the signs of bloat to getting professional help, this article is a must-read for any dog parent.

Low Iron Saturation: A Critical Health Indicator?: Did you know that low iron saturation can be a sign of a more serious health issue? Find out what causes low iron levels and why it’s crucial to monitor your iron saturation. From understanding the risks to learning how to boost your iron levels, this article is packed with valuable insights.