The weight of foreclosure can be crushing, not just financially but also emotionally. The stress and anxiety that come with facing a foreclosure can be overwhelming, especially when it’s reported on your credit report.

Removing Foreclosure From Credit Report: A Step-by-Step Guide

In this blog post, we’ll explore the process of removing a foreclosure from your credit report. Whether you’re trying to recover from a financial setback or simply want to improve your credit score, understanding how to remove a foreclosure is crucial.

The Importance of Removing Foreclosure from Credit Report

A foreclosure can significantly impact your credit score, making it harder to secure loans, mortgages, and even credit cards. The longer the foreclosure remains on your report, the more it weighs you down. In fact, according to the Federal Reserve, 37 million Americans have a foreclosure on their credit report, with many struggling to regain financial stability.

That’s why removing a foreclosure from your credit report is essential for rebuilding your credit and moving forward. Not only can it improve your credit score, but it can also give you peace of mind knowing that the weight of the foreclosure is lifted.

The importance of removing a foreclosure from your credit report cannot be overstated. When you’re trying to recover from a financial setback, the last thing you need is an added burden on your credit score. Foreclosures can stay on your report for up to seven years, which is a long time to carry the weight of that negative mark.

The Process of Removing Foreclosure from Credit Report

Removing a foreclosure from your credit report requires a multi-step approach. Here’s what you need to know:

The first step is to obtain a copy of your credit report from the three major credit reporting agencies: Equifax, Experian, and TransUnion. You can request a free report once a year through AnnualCreditReport.com.

Review your report carefully to ensure that all information is accurate, including the foreclosure. If you find any errors or inaccuracies, dispute them with the credit reporting agency immediately.

If the foreclosure is reported accurately, you’ll need to focus on improving your credit score over time. This can be achieved by:

Maintaining a good payment history: Paying bills on time and in full will help demonstrate your responsibility to lenders.

Keeping credit utilization low: Aim for a credit utilization ratio of 30% or less to show that you’re not overextending yourself.

Avoiding new negative marks: Steer clear of new foreclosures, collections, and late payments to prevent further damage to your credit score.

As you work on improving your credit score, keep in mind that the foreclosure will automatically fall off your report after seven years. However, this doesn’t mean that it won’t continue to have a negative impact on your credit score during that time. By focusing on rebuilding your credit and avoiding new negative marks, you can minimize the damage and set yourself up for long-term financial success.

For more information on how to remove a foreclosure from your credit report or improve your credit score in general, check out these resources:

In our next section, we’ll explore the benefits of removing a foreclosure from your credit report and provide additional tips for rebuilding your credit.

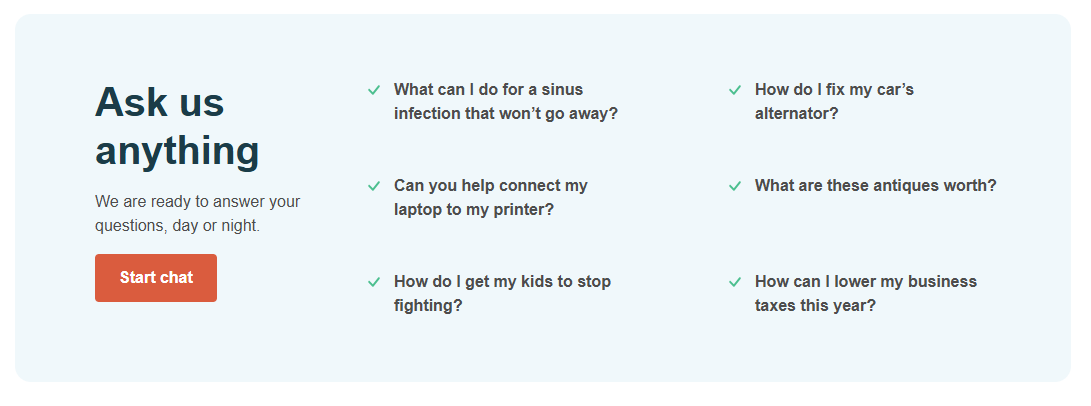

Get Expert Guidance on Credit Report Removal

Our finance experts are here to help you understand the process of removing foreclosure from your credit report.

Speak with a Finance ExpertThe weight of foreclosure can be crushing, not just financially but also emotionally. The stress and anxiety that come with facing a foreclosure can be overwhelming, especially when it’s reported on your credit report.

Removing Foreclosure From Credit Report: A Step-by-Step Guide

In this blog post, we’ll explore the process of removing a foreclosure from your credit report. Whether you’re trying to recover from a financial setback or simply want to improve your credit score, understanding how to remove a foreclosure is crucial.

The Importance of Removing Foreclosure from Credit Report

A foreclosure can significantly impact your credit score, making it harder to secure loans, mortgages, and even credit cards. The longer the foreclosure remains on your report, the more it weighs you down. In fact, according to the Federal Reserve, 37 million Americans have a foreclosure on their credit report, with many struggling to regain financial stability.

That’s why removing a foreclosure from your credit report is essential for rebuilding your credit and moving forward. Not only can it improve your credit score, but it can also give you peace of mind knowing that the weight of the foreclosure is lifted.

The Process of Removing Foreclosure from Credit Report

Now that we’ve discussed the importance of removing a foreclosure, let’s dive into the process. Here are the steps to remove a foreclosure from your credit report:

- Contact the credit reporting agency: Start by contacting the credit reporting agency (CRA) that reported the foreclosure on your credit report.

- Verify the information: Verify the accuracy of the foreclosure information and ensure it’s reported correctly.

- Dispute the error: Dispute the error with the CRA, providing supporting documentation to back up your claim.

- Wait for the response: Wait for the CRA’s response, which may take several weeks or months.

- Follow up: Follow up with the CRA if you don’t receive a response within the expected timeframe.

Conclusion

Removing a foreclosure from your credit report is possible with the right steps and documentation. By understanding the process and taking action, you can lift the weight of the foreclosure and start rebuilding your credit. Remember, it’s not just about improving your credit score – it’s about having peace of mind knowing that you’ve taken control of your financial situation.

Don’t let a foreclosure hold you back any longer. Take the first step today by contacting the credit reporting agency and starting the removal process. You got this!

Quantum Mechanical Model 5.3 Atomic Emission Spectra Quiz Answers: Got a curious mind and a love for science? Dive into the world of atomic emission spectra and test your knowledge with our comprehensive quiz answers!

A Typical Resting Heart Rate for a Normal Individual is Around…: Ever wondered what’s considered a normal heart rate? Learn the average resting heart rate for adults and get insights into how it affects your overall health!