The elusive Black Card – a status symbol that’s as coveted as it is misunderstood.

Online Revoked Questions and Answers About the Black Card

In today’s digital age, we’re constantly bombarded with questions about credit cards, their benefits, and what it takes to get your hands on the most exclusive of them all – the Black Card. But amidst the hype and speculation, one question stands out: what exactly is a Black Card, and why do people seem so obsessed with getting their hands on one?

What’s So Special About the Black Card?

The Black Card, also known as the Centurion Card or the American Express Platinum Card, is an invitation-only credit card that offers unparalleled rewards and benefits to its esteemed members. With a hefty annual fee of $5,000 (yes, you read that right!), it’s no wonder people are willing to jump through hoops to get their hands on one.

But what sets the Black Card apart from your run-of-the-mill credit cards? For starters, cardholders enjoy unparalleled travel perks, including airport lounge access, hotel upgrades, and even private concierge services. They also receive premium rewards like statement credits, purchase protection, and exclusive events – all of which are designed to make their lives easier, more luxurious, and incredibly rewarding.

In the next section, we’ll delve deeper into what it takes to become a Black Card member, from meeting the eligibility criteria to navigating the application process. But for now, let’s just say that getting your hands on one of these coveted cards is not for the faint of heart – or wallet!

The elusive Black Card – a status symbol that’s as coveted as it is misunderstood.

Online Revoked Questions and Answers About the Black Card

In today’s digital age, we’re constantly bombarded with questions about credit cards, their benefits, and what it takes to get your hands on the most exclusive of them all – the Black Card. But amidst the hype and speculation, one question stands out: what exactly is a Black Card, and why do people seem so obsessed with getting their hands on one?

What’s So Special About the Black Card?

The Black Card, also known as the Centurion Card or the American Express Platinum Card, is an invitation-only credit card that offers unparalleled rewards and benefits to its esteemed members. With a hefty annual fee of $5,000 (yes, you read that right!), it’s no wonder people are willing to jump through hoops to get their hands on one.

But what sets the Black Card apart from your run-of-the-mill credit cards? For starters, cardholders enjoy unparalleled travel perks, including airport lounge access, hotel upgrades, and even private concierge services. They also receive premium rewards like statement credits, purchase protection, and exclusive events – all of which are designed to make their lives easier, more luxurious, and incredibly rewarding.

One of the most significant benefits of the Black Card is its ability to simplify travel planning. With the card, you can earn points on flights booked through American Express Travel, as well as enjoy exclusive access to luxury hotel partners like the Four Seasons and The Ritz-Carlton. And if you’re a frequent flyer, you’ll appreciate the card’s ability to provide real-time flight alerts and personalized travel recommendations.

But the Black Card is more than just a tool for frequent travelers – it’s also a status symbol that screams luxury and exclusivity. Imagine having access to exclusive events, like invite-only concerts or VIP experiences at top fashion shows. It’s not just about the benefits; it’s about being part of an elite group of individuals who share your refined tastes and appreciation for the finer things in life.

What Does it Take to Get a Black Card?

So, how do you get your hands on one of these coveted cards? The process is shrouded in mystery, but here’s what we know: American Express has strict eligibility criteria, including high credit scores and significant spending habits. You’ll need to demonstrate a strong financial history, with a proven track record of responsible credit use.

If you’re wondering how to increase your chances of getting approved for the Black Card, the answer is simple: build a strong credit profile by paying your bills on time, keeping your debt low, and avoiding unnecessary inquiries. And if you’re already an American Express customer, consider upgrading to a higher-end card like the Platinum or Gold to get closer to the Black Card’s exclusive benefits.

As we explore more of the ins and outs of the Black Card in our next section, one thing is clear: getting your hands on this coveted card requires dedication, persistence, and a willingness to go above and beyond. But for those who make the cut, the rewards are well worth the effort – as long as you’re prepared to part with that hefty annual fee!

Want to learn more about the Black Card’s benefits and how to increase your chances of getting approved? Check out this comprehensive guide by CreditCards.com.

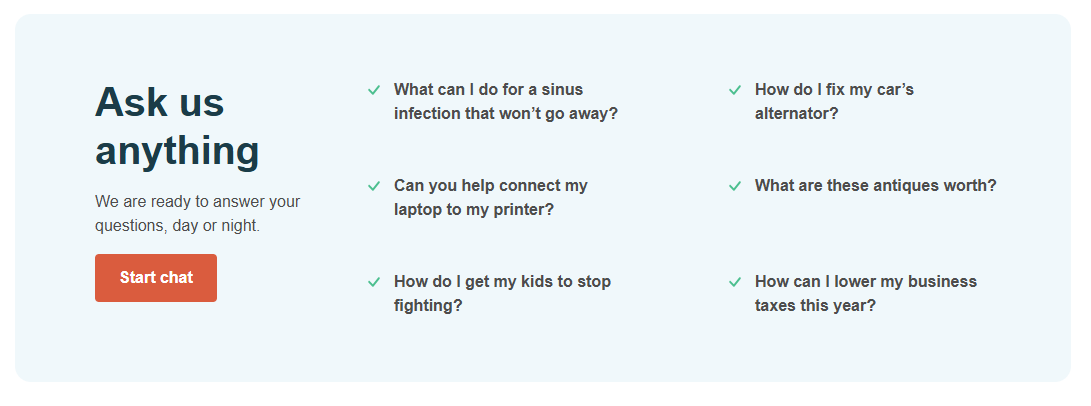

Unlock the Secrets of the Black Card

Get instant access to expert insights and start maximizing your financial potential.

Start chatThe elusive Black Card – a status symbol that’s as coveted as it is misunderstood.

Online Revoked Questions and Answers About the Black Card

In today’s digital age, we’re constantly bombarded with questions about credit cards, their benefits, and what it takes to get your hands on the most exclusive of them all – the Black Card. But amidst the hype and speculation, one question stands out: what exactly is a Black Card, and why do people seem so obsessed with getting their hands on one?

What’s So Special About the Black Card?

The Black Card, also known as the Centurion Card or the American Express Platinum Card, is an invitation-only credit card that offers unparalleled rewards and benefits to its esteemed members. With a hefty annual fee of $5,000 (yes, you read that right!), it’s no wonder people are willing to jump through hoops to get their hands on one.

But what sets the Black Card apart from your run-of-the-mill credit cards? For starters, cardholders enjoy unparalleled travel perks, including airport lounge access, hotel upgrades, and even private concierge services. They also receive premium rewards like statement credits, purchase protection, and exclusive events – all of which are designed to make their lives easier, more luxurious, and incredibly rewarding.

So, what’s the takeaway from our journey into the world of the Black Card? For those who have earned this esteemed status symbol, it represents a badge of honor – a testament to their financial prowess and commitment to living life on their own terms. And for the rest of us, well, it serves as a reminder that with great privilege comes great responsibility (and a seriously impressive credit score).

And so, we leave you with this: if you’re one of the select few who’s earned your Black Card, congratulations are in order! You’ve truly earned the right to join an exclusive club. And for those still striving to reach the pinnacle of credit card status, keep pushing – it may just be worth the effort.

Read the case study mcroy aerospace on page 332 and answer questions 4 and 5 on page 333: Dive into this fascinating real-life case study to explore the challenges faced by McRoy Aerospace. Are you ready to test your knowledge and gain valuable insights from a real-world scenario?

1 urine protein: understanding its significance: Unlock the secrets of your urinary system! Discover why urine protein is crucial for maintaining overall health, and learn how to interpret its levels to prevent potential complications. Don’t miss this opportunity to gain a deeper understanding of your body’s functions.