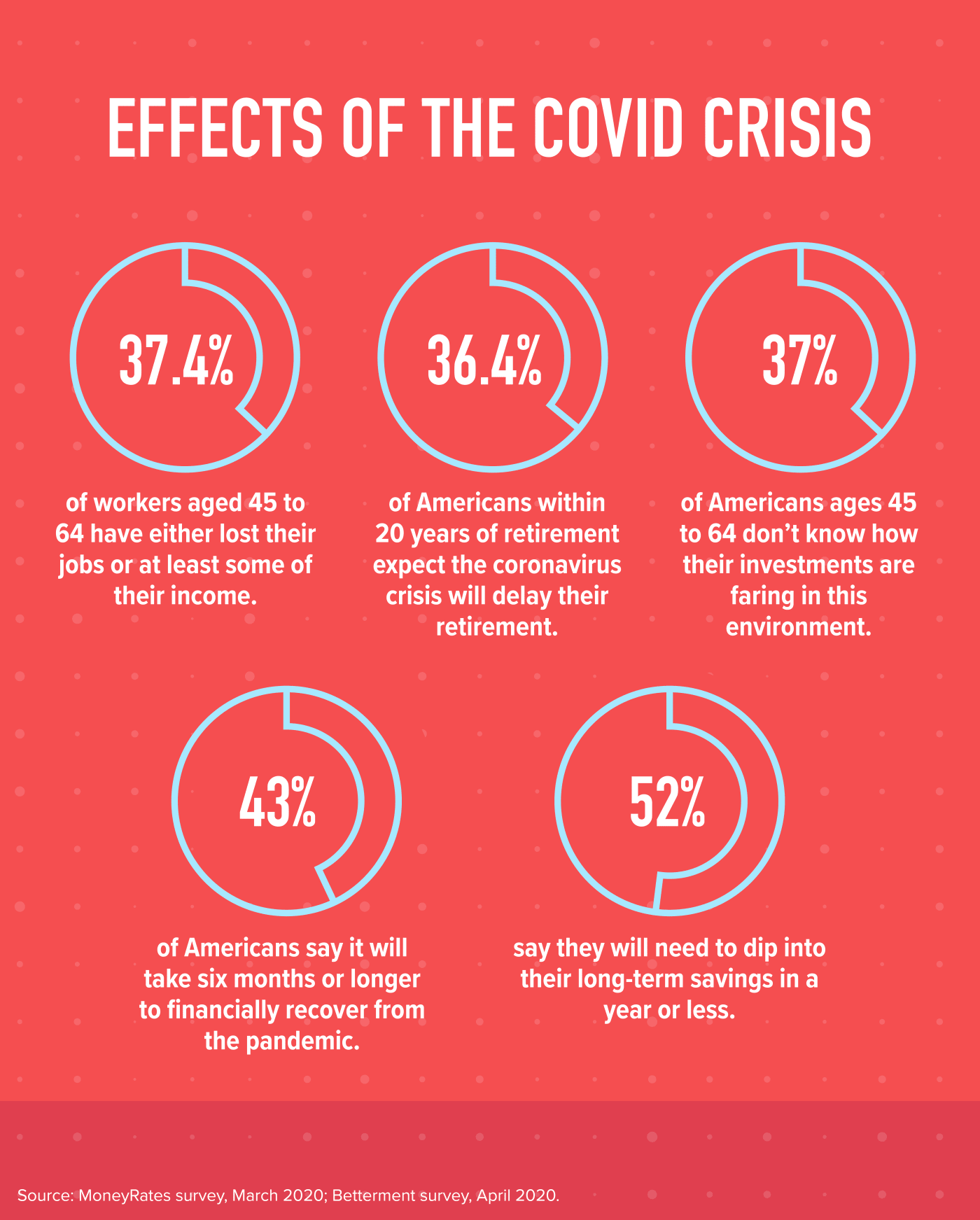

The COVID-19 pandemic has brought unprecedented uncertainty and disruption to our lives, leaving many of us wondering what the future holds for our financial security.

Early Withdrawal Penalty for 401k Plans During COVID-19 Crisis

In this challenging environment, it’s natural to feel anxious about accessing your retirement savings. However, making an early withdrawal from a 401(k) plan can have severe consequences, including penalties and potential long-term financial repercussions.

The Problem with Early Withdrawal Penalties

Before the COVID-19 pandemic, many employees had accumulated a significant amount of retirement savings in their 401(k) plans. As the crisis unfolded, many individuals were faced with unexpected expenses, such as medical bills, reduced income, or increased living costs. In this context, accessing these retirement funds may seem like an attractive solution to cover immediate needs.

However, making an early withdrawal from a 401(k) plan can trigger a penalty of up to 10% of the withdrawn amount, in addition to any applicable federal and state income taxes. This penalty is designed to discourage individuals from raiding their retirement accounts before reaching age 59 1/2, when withdrawals are generally allowed without penalties.

In the next section, we will explore the implications of early withdrawal penalties for 401(k) plans during the COVID-19 crisis and discuss potential alternatives for those facing financial strain.

The COVID-19 pandemic has brought unprecedented uncertainty and disruption to our lives, leaving many of us wondering what the future holds for our financial security.

Early Withdrawal Penalty for 401k Plans During COVID-19 Crisis

In this challenging environment, it’s natural to feel anxious about accessing your retirement savings. However, making an early withdrawal from a 401(k) plan can have severe consequences, including penalties and potential long-term financial repercussions.

The Problem with Early Withdrawal Penalties

Before the COVID-19 pandemic, many employees had accumulated a significant amount of retirement savings in their 401(k) plans. As the crisis unfolded, many individuals were faced with unexpected expenses, such as medical bills, reduced income, or increased living costs. In this context, accessing these retirement funds may seem like an attractive solution to cover immediate needs.

However, making an early withdrawal from a 401(k) plan can trigger a penalty of up to 10% of the withdrawn amount, in addition to any applicable federal and state income taxes. This penalty is designed to discourage individuals from raiding their retirement accounts before reaching age 59 1/2, when withdrawals are generally allowed without penalties.

Consequences of Early Withdrawal

If you withdraw funds from your 401(k) plan before age 59 1/2, you may be subject to a 10% penalty, which can significantly reduce the amount available for retirement. For example, if you have $50,000 in your 401(k) account and make an early withdrawal of $20,000, you would face a penalty of $2,000 (10% of the withdrawn amount). Additionally, the withdrawn amount will be subject to income taxes, further reducing its value.

This can lead to long-term financial consequences, such as depleting your retirement savings and impacting your overall financial security. It’s essential to consider these consequences before making an early withdrawal from a 401(k) plan.

Alternatives to Early Withdrawal

If you’re facing financial strain during the COVID-19 crisis, there are alternative options to consider:

- The IRS has expanded access to retirement savings plans, allowing certain individuals to make penalty-free withdrawals from their 401(k) or IRA accounts.

- You may be eligible for a hardship withdrawal, which allows you to take a limited amount of funds from your 401(k) plan without incurring the early withdrawal penalty. However, this option should only be considered as a last resort, as it can have long-term financial implications.

In our next section, we’ll explore more alternatives and strategies for managing your retirement savings during the COVID-19 crisis.

Expert Guidance on Early Withdrawal Penalty for 401k Plans During COVID-19 Crisis

We are ready to answer your questions, day or night.

Start chatIn this challenging environment, it’s natural to feel anxious about accessing your retirement savings. However, making an early withdrawal from a 401(k) plan can have severe consequences, including penalties and potential long-term financial repercussions.

Early Withdrawal Penalty for 401k Plans During COVID-19 Crisis

In this challenging environment, it’s natural to feel anxious about accessing your retirement savings. However, making an early withdrawal from a 401(k) plan can have severe consequences, including penalties and potential long-term financial repercussions.

The Problem with Early Withdrawal Penalties

Before the COVID-19 pandemic, many employees had accumulated a significant amount of retirement savings in their 401(k) plans. As the crisis unfolded, many individuals were faced with unexpected expenses, such as medical bills, reduced income, or increased living costs. In this context, accessing these retirement funds may seem like an attractive solution to cover immediate needs.

However, making an early withdrawal from a 401(k) plan can trigger a penalty of up to 10% of the withdrawn amount, in addition to any applicable federal and state income taxes. This penalty is designed to discourage individuals from raiding their retirement accounts before reaching age 59 1/2, when withdrawals are generally allowed without penalties.

Key Points Covered So Far

We’ve discussed the importance of considering the early withdrawal penalty for 401(k) plans during the COVID-19 crisis. To recap:

- Making an early withdrawal from a 401(k) plan can have severe consequences, including penalties and potential long-term financial repercussions.

- The penalty for early withdrawal is up to 10% of the withdrawn amount, in addition to any applicable federal and state income taxes.

Final Insights

In conclusion, while accessing retirement savings may seem like a tempting solution during times of financial strain, it’s essential to carefully consider the potential consequences. Instead of raiding your 401(k) plan, explore alternative options for addressing immediate needs:

- Consult with a financial advisor or planner to develop a personalized strategy.

- Consider taking out a personal loan or credit card with a lower interest rate than the early withdrawal penalty.

- Explore government assistance programs or emergency loans, if available in your area.

A Strong Conclusion

The COVID-19 pandemic has brought unprecedented uncertainty to our lives. As we navigate this crisis, it’s crucial to prioritize long-term financial security and avoid making hasty decisions that may have lasting repercussions. By understanding the early withdrawal penalty for 401(k) plans during the COVID-19 crisis, you can make informed decisions about your retirement savings and position yourself for a stronger financial future.