As you work towards securing your financial future, you might have noticed that your 401(k) plan has become a crucial component of your overall retirement strategy. It’s no secret that compound interest can work wonders for your savings, but there’s another aspect to consider: the early withdrawal penalty.

The Hidden Cost of Early Withdrawal

When you think about withdrawing from your 401(k), the initial thought might be “What’s the big deal? It’s my money!” But, as we’ll explore further in this post, there’s a significant cost associated with early withdrawal that can have long-term consequences for your financial well-being.

The Early Withdrawal Penalty: A Key Factor to Consider

In general, most 401(k) plans come with a 10% penalty for withdrawals made before age 59½. Yes, you read that correctly – 10%! This penalty is designed to encourage plan participants to keep their savings intact and let them compound over time. But what happens when you need access to your funds earlier than expected?

Next section: Understanding the Exceptions to the Rule

As you work towards securing your financial future, you might have noticed that your 401(k) plan has become a crucial component of your overall retirement strategy. It’s no secret that compound interest can work wonders for your savings, but there’s another aspect to consider: the early withdrawal penalty.

The Hidden Cost of Early Withdrawal

When you think about withdrawing from your 401(k), the initial thought might be “What’s the big deal? It’s my money!” But, as we’ll explore further in this post, there’s a significant cost associated with early withdrawal that can have long-term consequences for your financial well-being.

The Early Withdrawal Penalty: A Key Factor to Consider

In general, most 401(k) plans come with a 10% penalty for withdrawals made before age 59½. Yes, you read that correctly – 10%! This penalty is designed to encourage plan participants to keep their savings intact and let them compound over time. But what happens when you need access to your funds earlier than expected?

Why the Penalty Matters

The early withdrawal penalty might seem like a minor issue, but it can have a significant impact on your retirement savings. Let’s consider an example:

John has been contributing to his 401(k) for several years and has built up a nest egg of $50,000. He decides to retire at age 62 and wants to withdraw $20,000 to cover some unexpected expenses. If he doesn’t take the early withdrawal penalty into account, he might assume he’ll be left with $40,000 (after withdrawing $20,000). However, by taking the 10% penalty, John would actually be left with only $36,000 – a significant difference.

This example illustrates why it’s crucial to consider the early withdrawal penalty when planning your retirement strategy. It’s not just about the initial amount withdrawn; it’s about the long-term impact on your savings and financial security.

Exceptions to the Rule: When You Can Avoid the Penalty

While the 10% penalty is a general rule, there are some exceptions that can help you avoid this costly withdrawal:

- IRS rules permit penalty-free withdrawals for certain expenses, such as first-time homebuyers or education costs.

- You may be eligible for a hardship withdrawal if you need the funds to cover unexpected expenses, such as medical emergencies or funeral expenses.

- Some employers offer in-service loans or hardship distributions that allow you to withdraw funds without penalty (though interest may apply).

In these situations, it’s essential to review your plan’s rules and consult with a financial advisor before making any withdrawals. Remember, even with exceptions, it’s crucial to consider the long-term implications of early withdrawal on your retirement savings.

Next section: Strategies for Minimizing the Penalty Impact

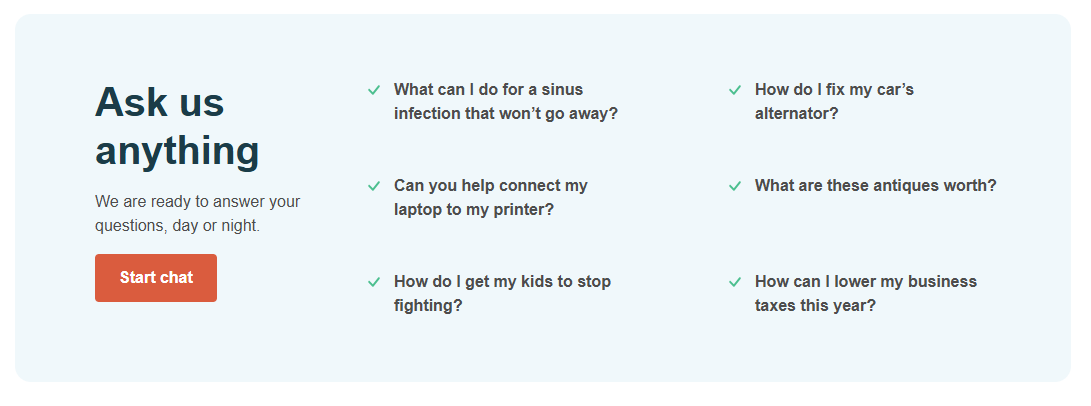

Get Expert Guidance on 401k Withdrawal Penalties

Don’t let penalties hold you back from making informed decisions about your retirement savings. Our finance experts are here to help.

Start chatIn our previous sections, we’ve explored the importance of considering the early withdrawal penalty when accessing your 401(k) funds. To recap, here are the key points covered so far:

- The early withdrawal penalty for 401(k) plans is typically 10% of the withdrawn amount.

- This penalty is designed to encourage plan participants to keep their savings intact and let them compound over time.

As we discussed earlier, it’s essential to understand the exceptions to the rule before making a withdrawal. However, even with these exceptions in place, it’s crucial to weigh the benefits against the potential penalties and long-term consequences.

In conclusion, the early withdrawal penalty is an important consideration for anyone planning their financial future. While it may seem like a minor detail, the 10% penalty can have significant impacts on your overall savings and retirement goals. By taking the time to understand the rules and exceptions, you can make informed decisions about when to access your funds and avoid costly mistakes.

Remember, patience is often rewarded in the world of finance. Letting your savings compound over time can lead to a more secure financial future. So, before making a withdrawal, take a step back, assess your options, and consider the long-term implications. Your future self will thank you!

The treatment cost of hepatitis C: Are you concerned about the financial implications of treating hepatitis C? In this article, we break down the costs associated with different treatment options and explore ways to make treatment more affordable.

What is 1 bilirubin in dog urine a comprehensive guide: If you’re a dog owner, understanding canine health markers like bilirubin levels can help you identify potential issues early on. In this in-depth guide, we’ll walk you through what 1 bilirubin in dog urine means and how to interpret the results.