Losing a loved one is never easy, but what about the financial security they worked hard to provide for you? As the spouse of a deceased person who was receiving Social Security benefits, you may be wondering if you’re eligible to continue collecting those benefits while also working. It’s a complex topic, but one that’s crucial to understand, especially as more people rely on Social Security as a vital source of income.

Can I Collect My Deceased Husband’s Social Security and Still Work?

In this post, we’ll explore the ins and outs of survivor benefits and how they intersect with your own career goals. Whether you’re looking to return to work or start a new chapter in your life, it’s essential to understand your options and what’s required.

A Brief Overview of Survivor Benefits

When someone passes away while receiving Social Security benefits, their spouse (or ex-spouse) may be eligible for survivor benefits. These benefits are designed to provide financial support to the surviving partner, helping them adjust to life without their loved one. The amount of the benefit depends on the deceased person’s primary insurance amount (PIA), which is based on their own Social Security earnings record.

Now that we’ve set the stage, let’s dive into the first key point: what happens if you’re already receiving survivor benefits and start working again? Is there a limit to how much you can earn before your benefits are affected?

Losing a loved one is never easy, but what about the financial security they worked hard to provide for you? As the spouse of a deceased person who was receiving Social Security benefits, you may be wondering if you’re eligible to continue collecting those benefits while also working. It’s a complex topic, but one that’s crucial to understand, especially as more people rely on Social Security as a vital source of income.

Can I Collect My Deceased Husband’s Social Security and Still Work?

In this post, we’ll explore the ins and outs of survivor benefits and how they intersect with your own career goals. Whether you’re looking to return to work or start a new chapter in your life, it’s essential to understand your options and what’s required.

A Brief Overview of Survivor Benefits

When someone passes away while receiving Social Security benefits, their spouse (or ex-spouse) may be eligible for survivor benefits. These benefits are designed to provide financial support to the surviving partner, helping them adjust to life without their loved one. The amount of the benefit depends on the deceased person’s primary insurance amount (PIA), which is based on their own Social Security earnings record.

Now that we’ve set the stage, let’s dive into the first key point: what happens if you’re already receiving survivor benefits and start working again? Is there a limit to how much you can earn before your benefits are affected?

The Earning Limit for Survivor Benefits

According to the Social Security Administration (SSA), if you’re receiving survivor benefits and start working, there is an earning limit. You can earn up to $19,560 per year without affecting your benefits. If you exceed this limit, your benefits will be reduced by a certain percentage based on how much you’ve earned above the threshold. For example, if you earn $20,000 in a year, your benefits might be reduced by 50%.

But here’s an important consideration: even if you’re earning below the threshold, you may still need to report your income to Social Security. This is because they use your earnings record to determine your future benefits and whether you’ll continue to qualify for survivor benefits.

Making It Work

So, how can you make it work if you’re receiving survivor benefits and want to start working again? Here are a few strategies:

Start small. If you’re returning to work after a long break, consider starting with part-time hours or a flexible schedule to ease back into the workforce.

Talk to your employer. Your HR department may be able to help you navigate any changes to your benefits and compensation package as you start working again.

Consider consulting with a financial advisor. They can help you create a personalized plan for managing your finances and making the most of your survivor benefits while working.

We’ll be exploring more aspects of survivor benefits and how they intersect with your own career goals in our next post. Stay tuned for Part 2!

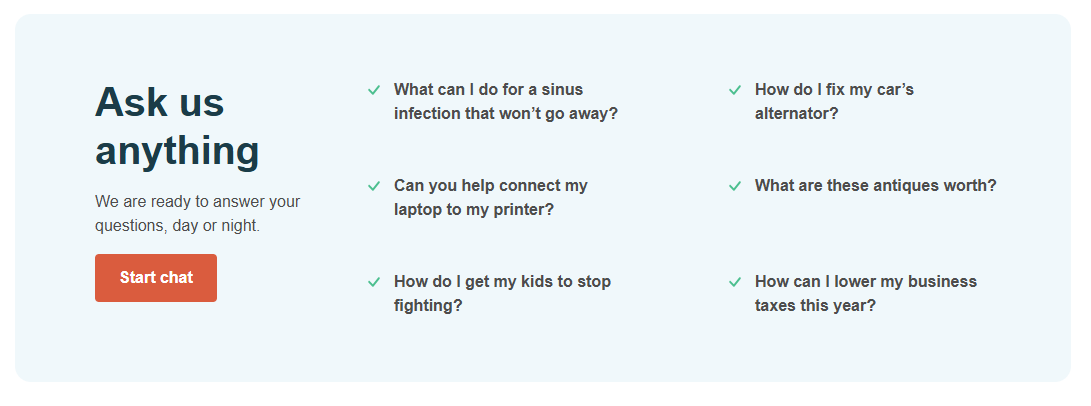

Learn more about survivor benefits from the Social Security Administration.Get Expert Guidance on Your Social Security Benefits

Let our experienced finance experts help you navigate the complexities of collecting your deceased husband’s social security benefits while still working.

Start chatNow that we’ve covered the basics of survivor benefits and how they intersect with your own career goals, let’s summarize the key points:

- If you’re already receiving survivor benefits and start working again, there is a limit to how much you can earn before your benefits are affected.

- The Social Security Administration (SSA) uses a complex formula to determine whether your earnings will impact your benefits. The general rule is that for every two dollars you earn above $18,960 in 2022, one dollar of your survivor benefit will be withheld.

- If you’re under full retirement age (which varies depending on your birth year), there’s a more significant reduction in benefits if you earn above a certain threshold. In 2022, that threshold is $19,560.

- However, if you reach full retirement age (65-67 years old, depending on when you were born) and start working again, the rules change. You can earn as much as you want without affecting your survivor benefits.

So, what’s the takeaway from all this? While it may seem daunting to navigate the ins and outs of Social Security survivor benefits while working, it’s essential to understand your options and what’s required. Whether you’re looking to return to work or start a new chapter in your life, knowing how your earnings will impact your benefits can help you make informed decisions about your financial future.

In conclusion, collecting your deceased husband’s Social Security benefits while working requires careful consideration of the rules and regulations surrounding survivor benefits. By understanding what happens when you earn above certain thresholds, you can make more informed choices about your career and financial goals. Remember, it’s always a good idea to consult with the Social Security Administration or a qualified financial advisor if you have specific questions or concerns.

Symptoms of Fatty Liver due to Alcohol Consumption: Don’t let a boozy night turn into a health concern. Learn about the warning signs and symptoms of fatty liver disease caused by excessive drinking, and find out how you can take steps to prevent this condition.

Miss Periods on the Pill – Can You?: Are you taking birth control pills but missing periods? Don’t stress! Our expert guide explains what’s normal and what’s not, helping you navigate any concerns or side effects. Click to learn more about how your pill can affect your menstrual cycle.