Are you tired of feeling like you’re navigating tax season solo? You’re not alone!

Ask Tax Questions for Free: A Lifeline for Confused Filers

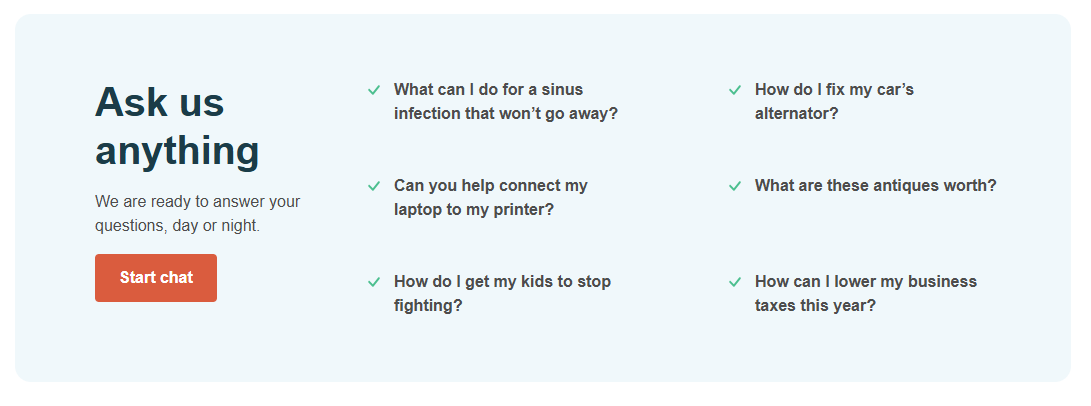

As the old saying goes, “nothing is certain except death and taxes.” But what if you’re unsure about how to tackle those taxes? Filing your taxes can be a daunting task, especially with ever-changing laws and regulations. It’s enough to make your head spin! That’s why we’re excited to introduce our new series: “Ask Tax Questions for Free.”

Why It Matters

Taxes may not be the most glamorous topic, but they’re an essential part of being a responsible adult. With the IRS sending out more than 150 million tax returns each year, it’s no wonder that many people feel overwhelmed by the process. But what if you could get the answers you need without breaking the bank or sacrificing your sanity? That’s where our “Ask Tax Questions for Free” series comes in.

What You’ll Learn

In this first installment, we’re going to tackle a common question that plagues many taxpayers: “What is my tax obligation as an independent contractor?” We’ll dive into the ins and outs of self-employment taxes, including what you need to know about quarterly estimated tax payments. Whether you’re just starting out in your career or have been freelancing for years, this information will help you better understand your tax responsibilities.

As we dive deeper into our “Ask Tax Questions for Free” series, it’s essential to understand the importance of seeking tax advice from qualified professionals. With the complexities of tax laws and regulations, it’s easy to make costly mistakes that can result in penalties and interest.

The Benefits of Seeking Free Tax Advice

By asking tax questions for free, you’ll gain a better understanding of your tax obligations as an independent contractor. This knowledge will help you avoid common pitfalls and take advantage of available deductions and credits. For example, did you know that the IRS allows freelancers to deduct business expenses on Schedule C? By claiming these expenses correctly, you can reduce your taxable income and lower your tax bill.

Common Tax Questions for Independent Contractors

As an independent contractor, you’re considered self-employed and are required to report your income and pay self-employment taxes. Here are some common tax questions that we’ll be addressing in this series:

- What is my tax obligation as an independent contractor?

- How do I calculate my self-employment taxes?

- What deductions can I claim on Schedule C?

- When and how do I make quarterly estimated tax payments?

To get started, let’s tackle the first question: what is my tax obligation as an independent contractor? As we discussed earlier, as a freelancer, you’re considered self-employed and are required to report your income on Schedule C. This form allows you to claim business expenses that can help reduce your taxable income.

Next week, we’ll dive into calculating your self-employment taxes and exploring the deductions available on Schedule C. Stay tuned for more valuable insights and expert advice from our team of tax professionals!

In this series, we’ve covered some of the most common tax questions that plague independent contractors. We’ve explored what it means to be an independent contractor from a tax perspective and how you can avoid costly mistakes when filing your taxes.

Summarizing the Key Points

We started by asking “What is my tax obligation as an independent contractor?” and discovered that self-employment taxes are a crucial part of being a freelancer. We also learned about quarterly estimated tax payments and how they can help you avoid penalties and interest.

Final Insights

If there’s one thing we’ve learned from this series, it’s that asking questions is key to navigating the world of taxes as an independent contractor. Don’t be afraid to seek guidance from a qualified tax professional or take advantage of free resources available online.

Conclusion: Take Control of Your Taxes

Taxes don’t have to be intimidating! By understanding your tax obligations and taking proactive steps, you can avoid stress and financial penalties. Remember, it’s always better to ask questions than to risk making costly mistakes. So go ahead, take control of your taxes, and start building a stronger financial future for yourself.

Unlock the Nutritional Power of Black Beans: Black beans are more than just a tasty addition to your favorite dishes – they’re also packed with essential nutrients that can boost your health. From protein and fiber to folate and iron, discover why black beans should be a staple in your diet.

What’s Behind That Non-Itchy Rash on Your Back and Chest?: Ever woken up to find an unexplained rash on your back or chest? While it may not be the most comfortable experience, there are plenty of non-alarming explanations for this phenomenon. Learn more about what could be causing your non-itchy rash, and how you can get relief.