Are you tired of watching your hard-earned money stagnate in your bank account, earning barely any interest? Do you wish you could turn that money into a more profitable venture, but don’t know where to start?

Converting Your Money Now: A Guide to Making Your Cash Work for You

In today’s economy, it’s more important than ever to make your money work for you. With interest rates at historic lows and inflation on the rise, it’s crucial to find ways to grow your wealth and protect its purchasing power.

Why Converting Your Money Now Matters

The key to converting your money now is understanding how different financial instruments work together to help you achieve your goals. This includes recognizing the importance of diversification, taking calculated risks, and being proactive in managing your finances. By doing so, you can ensure that your hard-earned cash is working towards a brighter financial future.

Worksheet Answers: Unlocking the Power of Converting Your Money

In this blog post, we’ll be exploring the 04.01 worksheet answers and providing a step-by-step guide on how to convert your money now. From understanding the concept of time value of money to recognizing the importance of compounding interest, we’ll cover it all.

So, let’s get started! In our next section, we’ll dive deeper into the world of converting your money and explore the first key point: understanding the power of compound interest. Stay tuned!

As we explored earlier, understanding the concept of compound interest is a crucial step in converting your money now. But what exactly is compound interest, and how can it work in your favor?

The Magic of Compound Interest

Compound interest is the process by which an investment grows exponentially over time due to the compounding effect of interest earned on previous interest. In other words, as your money earns interest, that interest is reinvested, allowing it to grow even further.

To illustrate this concept, let’s consider a simple example. Suppose you invest $1,000 in a high-yield savings account with an annual interest rate of 2%. At the end of the first year, your investment would earn $20 in interest, bringing the total balance to $1,020.

In the second year, the interest rate remains the same, but the principal amount is now $1,020. As a result, the interest earned in the second year would be calculated on the higher principal amount, resulting in a greater return.

This compounding effect can have a significant impact on your investment over time. According to Bankrate, if you leave the same $1,000 invested for 10 years at an annual rate of 2%, you could earn nearly $250 in interest, bringing the total balance to over $1,250.

Why Compound Interest Matters

The power of compound interest lies in its ability to grow your investment exponentially over time. By understanding how compound interest works, you can make informed decisions about where to invest your money and how to maximize its growth potential.

As we move forward with our 04.01 worksheet answers, it’s essential to recognize the importance of compounding interest in converting your money now. In the next section, we’ll explore another crucial concept: understanding the time value of money. Stay tuned!

Learn more about compound interest and how it can benefit your investments. Discover the impact of compounding interest on long-term investment returnsGet Expert Financial Guidance

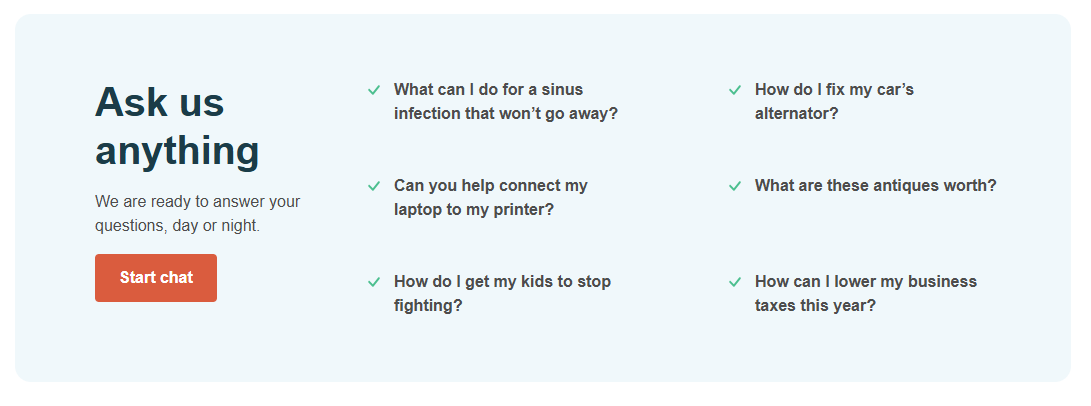

Mastering your finances just got a whole lot easier. Our team of finance experts is ready to answer your questions and provide personalized advice.

Start chatIn conclusion, converting your money now is not just about making a profit, but it’s also about taking control of your financial future. By understanding the power of compound interest and recognizing the importance of diversification, you can unlock the true potential of your hard-earned cash.

As we’ve seen in this blog post, the 04.01 worksheet answers provide a comprehensive guide on how to convert your money now. From calculating the time value of money to understanding the impact of compounding interest, you’re now equipped with the knowledge and tools to make informed decisions about your finances.

So, what are you waiting for? Take control of your financial future today by converting your money now! Remember, every dollar counts, and even small changes can add up over time. Don’t let inflation get the best of you – start making your money work for you!

Don’t Ignore the Warning Signs: High Blood Sugar Alert!: Do you know that frequent urination can be a sign of high blood sugar? Learn about the surprising symptoms and what to do if you’re experiencing them. Don’t wait until it’s too late!

Find Your Perfect Match: The Best Dog for Apartment Living: Are you a single female looking for the paw-fect companion? Discover the top breeds that thrive in apartments, and get ready to experience the joys of dog ownership. Which breed will steal your heart?