Are you considering an early withdrawal from your 401(k) plan? Think twice! Withdrawing funds before age 59 1/2 can come with a hefty price: the Early Withdrawal Penalty. In this blog post, we’ll delve into the rules surrounding early withdrawals and help you understand how to avoid this costly mistake.

Why Does it Matter?

The Early Withdrawal Penalty is a significant consideration for anyone considering an early withdrawal from their 401(k) plan. With many Americans relying on these retirement accounts as a primary source of income, understanding the rules and potential consequences can make all the difference in securing a comfortable retirement.

What You Need to Know: The First Key Point

The first key point to understand is that the Early Withdrawal Penalty applies to withdrawals made before age 59 1/2. This includes both principal and earnings, making it essential to plan carefully if you need access to these funds earlier than expected.

For example, let’s say you have a $50,000 balance in your 401(k) account and withdraw $10,000 at age 55. The IRS would consider this an early withdrawal, subjecting you to the penalty. If the interest rate is 4%, the penalty would be approximately $400 (10% of the withdrawn amount). This may not seem like a lot, but it can add up quickly if you’re making repeated withdrawals.

Are you considering an early withdrawal from your 401(k) plan? Think twice! Withdrawing funds before age 59 1/2 can come with a hefty price: the Early Withdrawal Penalty. In this blog post, we’ll delve into the rules surrounding early withdrawals and help you understand how to avoid this costly mistake.

Why Does it Matter?

The Early Withdrawal Penalty is a significant consideration for anyone considering an early withdrawal from their 401(k) plan. With many Americans relying on these retirement accounts as a primary source of income, understanding the rules and potential consequences can make all the difference in securing a comfortable retirement.

What You Need to Know: The First Key Point

The first key point to understand is that the Early Withdrawal Penalty applies to withdrawals made before age 59 1/2. This includes both principal and earnings, making it essential to plan carefully if you need access to these funds earlier than expected.

For example, let’s say you have a $50,000 balance in your 401(k) account and withdraw $10,000 at age 55. The IRS would consider this an early withdrawal, subjecting you to the penalty. If the interest rate is 4%, the penalty would be approximately $400 (10% of the withdrawn amount). This may not seem like a lot, but it can add up quickly if you’re making repeated withdrawals.

Exceptions to the Rule

While the general rule is that early withdrawals are penalized, there are some exceptions to consider. If you meet certain criteria, you might be able to avoid the penalty:

- You left your job or employer after age 55 and started taking withdrawals from your 401(k) plan within 2 years of leaving.

- You’re using the funds for a qualified first-time home purchase (up to $10,000).

- You’re receiving disability benefits under Social Security rules.

- You’re serving in a war zone or qualifying military duty.

It’s essential to note that these exceptions might have their own specific rules and regulations. It’s crucial to review your situation with a qualified financial advisor to determine if you qualify for an exception.

Consequences of Ignoring the Penalty

If you withdraw funds early without meeting one of the above exceptions, you’ll face not only the penalty but also taxes on the withdrawn amount. This can significantly reduce your retirement savings and impact your overall financial situation.

For instance, let’s say you withdrew $20,000 from your 401(k) account at age 58. Assuming a 24% tax rate, you’d lose approximately $4,800 in taxes (24% of the withdrawn amount). Add the penalty to this total, and you’re looking at a significant financial hit.

As we’ll discuss further in our next section, it’s crucial to weigh the potential benefits of an early withdrawal against the potential consequences. Consider alternative options, such as borrowing from other sources or using emergency funds, before making a decision.

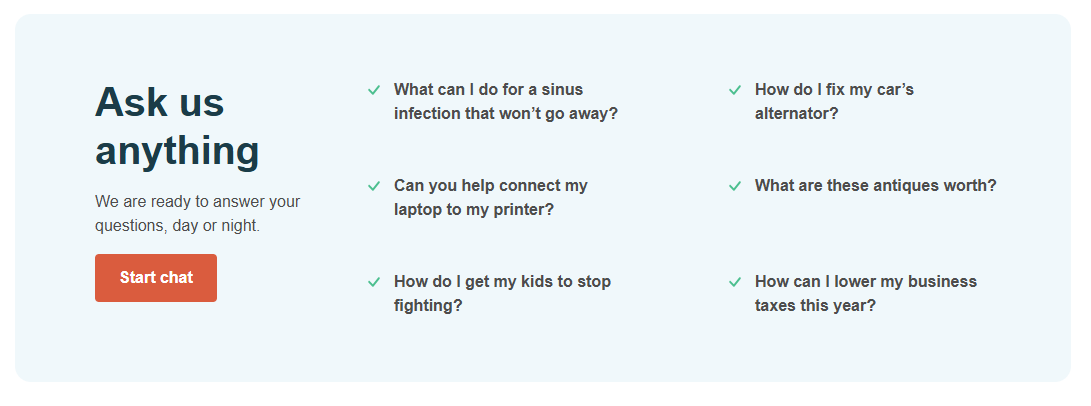

Expert Consultation

Seek personalized guidance from a financial expert to understand the implications of early withdrawal penalties on your 401(k) plan.

Start chatTo summarize our discussion, it’s essential to understand that the Early Withdrawal Penalty applies to withdrawals made before age 59 1/2 from your 401(k) plan. This includes both principal and earnings, making it crucial to plan carefully if you need access to these funds earlier than expected.

Key Takeaways

We’ve covered the following key points:

- The Early Withdrawal Penalty applies to withdrawals made before age 59 1/2 from your 401(k) plan.

- This includes both principal and earnings, making it essential to plan carefully if you need access to these funds earlier than expected.

Final Insights

If you’re considering an early withdrawal from your 401(k) plan, remember that the Early Withdrawal Penalty can be a significant cost. While it may seem like a minor fee, it can add up quickly over time. Before making any decisions, take the time to explore alternative options:

- Consider leaving your funds invested and growing tax-deferred.

- If you need access to cash, consider other sources such as an emergency fund or a brokerage account.

Avoid the Early Withdrawal Penalty: The Final Word

In conclusion, understanding the rules surrounding early withdrawals from your 401(k) plan is crucial for avoiding costly penalties. By planning carefully and considering alternative options, you can ensure that your retirement savings remain intact and continue to grow over time. Remember, patience and discipline are key to securing a comfortable retirement. Take control of your finances today and avoid the Early Withdrawal Penalty once and for all!