Losing a loved one is never easy, and when it’s your spouse, the grief can be overwhelming. As you navigate this difficult time, there may be many questions swirling in your mind – including what happens to our finances?

Collecting Social Security Benefits After Losing a Spouse: Can I Collect My Deceased Husband’s?

As the surviving spouse of a deceased husband, it’s natural to wonder if you can collect his Social Security benefits. The answer is yes, but there are specific rules and guidelines you need to understand. In this blog post, we’ll break down the process and provide valuable insights to help you navigate the system.

Why It Matters

When a spouse passes away, it’s essential to understand how their Social Security benefits will impact your financial situation. If your husband was receiving benefits or was eligible for them, you may be able to collect on his record. This can provide much-needed financial support during an already challenging time.

The Basics: Surviving Spouse Benefits

As the surviving spouse of a deceased worker, you may be eligible for survivor’s benefits if your husband was receiving Social Security benefits or was eligible for them at the time of his passing. These benefits are designed to provide financial support to the loved ones left behind.

To qualify, you typically need to meet certain requirements, such as:

- You were married to your deceased spouse for at least one year

- Your husband was receiving Social Security benefits or was eligible for them at the time of his passing

- You are currently not remarried (except in certain circumstances)

In our next section, we’ll dive deeper into the specifics of the survivor’s benefit program and what you need to know to get started.

In our previous section, we established that as a surviving spouse of a deceased husband, you may be eligible for survivor’s benefits if your husband was receiving Social Security benefits or was eligible for them at the time of his passing. Now, let’s dive deeper into the specifics of the program and what you need to know to get started.

The Survivor’s Benefit Program: What You Need to Know

The survivor’s benefit program is designed to provide financial support to the loved ones left behind when a worker passes away. To qualify, you typically need to meet certain requirements, including:

- You were married to your deceased spouse for at least one year

- Your husband was receiving Social Security benefits or was eligible for them at the time of his passing

- You are currently not remarried (except in certain circumstances)

- You are the surviving spouse, and you have not yet reached your full retirement age

Keep in mind that if your husband was under 62 when he passed away, you may still be eligible for benefits based on his record. However, if he was over 62, the benefit amount will be based on his actual benefits at the time of his passing.

How Much Can I Expect to Receive?

The survivor’s benefit amount is typically calculated as a percentage of your husband’s Social Security benefits at the time of his passing. The exact percentage depends on your age and whether you are receiving full or reduced benefits. For example, if your husband was receiving $2,000 per month in Social Security benefits when he passed away, and you’re 62 years old, your survivor’s benefit might be around $1,200 to $1,400 per month. However, this amount will vary depending on your individual circumstances.

If you’re unsure about the specifics of your situation or want a more accurate estimate, it’s always best to consult with the Social Security Administration directly. You can reach out to them at socialsecurity.gov or call 1-800-772-1213.

In our next section, we’ll explore some common questions and concerns that surviving spouses often have about collecting benefits after losing a loved one. Stay tuned!

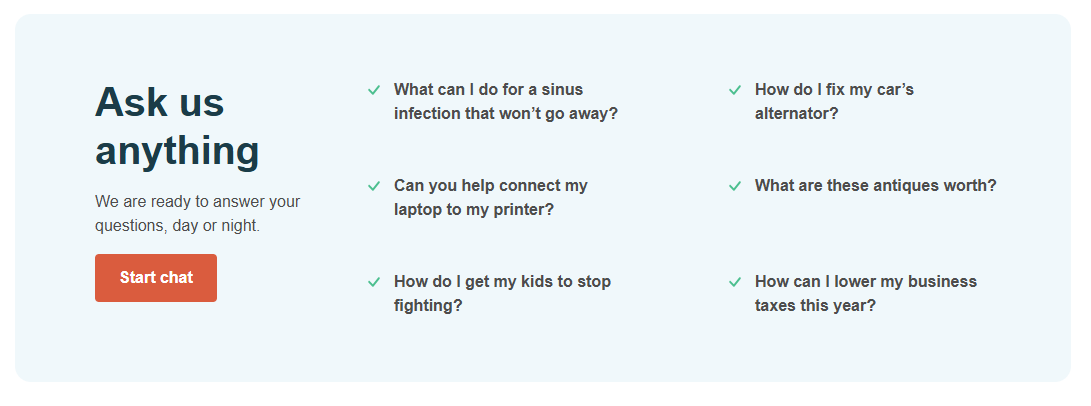

Expert Consultation for Social Security Benefits

Get personalized guidance and expert advice on collecting social security benefits after losing a spouse. Our finance experts are here to help.

Get Expert GuidanceIn our previous sections, we’ve covered the basics of collecting Social Security benefits after losing a spouse, including the requirements for survivor’s benefits and how to qualify. Now, let’s summarize the key points:

- You can collect your deceased husband’s Social Security benefits if you meet specific requirements

- To qualify, you typically need to have been married to your husband for at least one year, have him receive or be eligible for Social Security benefits at the time of his passing, and not be remarried (except in certain circumstances)

- The survivor’s benefit program is designed to provide financial support to the loved ones left behind

As you navigate this complex process, it’s essential to remember that each situation is unique. While these guidelines can help you get started, it’s crucial to consult with a Social Security representative or a qualified financial advisor to ensure you’re taking the right steps.

A Final Word

Losing a loved one is never easy, and dealing with the emotional and financial aftermath can be overwhelming. But by understanding your options for collecting Social Security benefits after losing a spouse, you can take control of your financial situation and ensure a more secure future.

Remember, it’s okay to ask for help and guidance along the way. With patience, persistence, and the right information, you can navigate this challenging time with confidence and clarity.

What is Average Pulse Rate by Age?: Ever wondered how fast your heart beats at different stages of life? Find out the average pulse rate for adults, children, and even newborns! Get the inside scoop on heart health!

Best Fitness Tracker with Oxygen Level and Blood Pressure: Stay on top of your fitness game with a tracker that monitors more than just steps! Find out which devices track oxygen levels, blood pressure, and more. Take control of your health!