Are you tired of feeling like tax season is a never-ending puzzle, with questions and uncertainties swirling around your head? You’re not alone! For many of us, taxes can be overwhelming, leaving us feeling anxious and unsure about what to do.

Free Answers To Tax Questions: Your Guide to Simplifying Tax Season

Tax season can be stressful, but it doesn’t have to be. That’s why we’re excited to introduce our new series of free answers to tax questions – a resource designed to help you navigate the complexities of tax season with confidence and clarity.

The Importance of Understanding Your Taxes

When it comes to taxes, understanding what’s expected of you is crucial. Whether you’re filing as an individual or a business, knowing the ins and outs of tax laws can save you time, money, and stress in the long run.

But let’s face it – taxes are complex, and even the most organized and financially savvy individuals can struggle to make sense of it all. That’s why we’re committed to providing free answers to your tax questions, helping you avoid costly mistakes and ensuring you get the most out of your hard-earned cash.

In this series, we’ll be diving into some of the most common tax-related questions and providing straightforward, easy-to-understand answers. From what constitutes a qualified business expense to how to maximize deductions for charitable donations, we’ve got you covered.

So, whether you’re a seasoned pro or just starting out, stay tuned for our next installment where we’ll explore the first key point in our series: [Insert topic here].

In our previous installment, we introduced our new series of free answers to tax questions – a resource designed to help you navigate the complexities of tax season with confidence and clarity.

Key Takeaways: Understanding Your Taxes

Simplifying tax season starts with understanding your taxes. Here are some key points to keep in mind:

- Filing status matters: Whether you’re single, married, or something else entirely, your filing status determines which tax forms you’ll need to file.

- Income is not the only consideration: Taxable income includes wages, salaries, tips, and other forms of compensation, but it’s not the only thing to consider. You may also have to report self-employment income, investment income, or income from rental properties.

- Deductions are crucial: By law, you’re allowed certain deductions on your tax return, such as the standard deduction or itemized deductions for things like charitable donations and mortgage interest.

- Credits can make a big difference: Tax credits can significantly reduce the amount of taxes you owe. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

By taking the time to understand these key points, you’ll be better equipped to navigate the tax season with confidence. But we know that taxes are complex, and even the most organized individuals can struggle to make sense of it all.

That’s why we’re committed to providing free answers to your tax questions. Whether you have a simple question or a more complex concern, our goal is to provide straightforward, easy-to-understand answers that help you avoid costly mistakes and ensure you get the most out of your hard-earned cash.

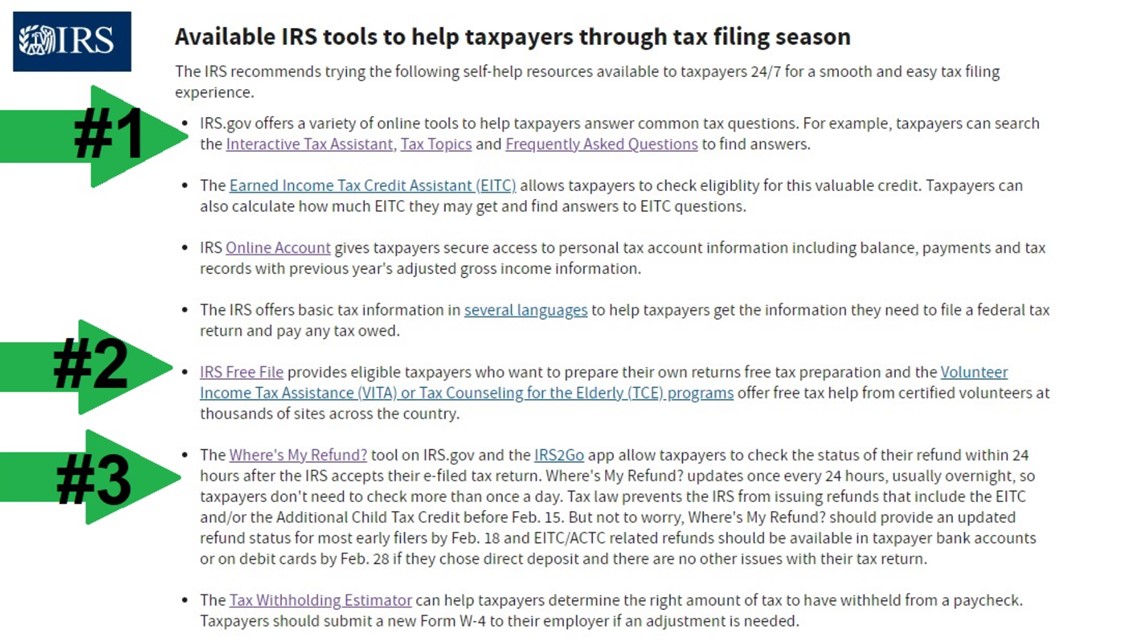

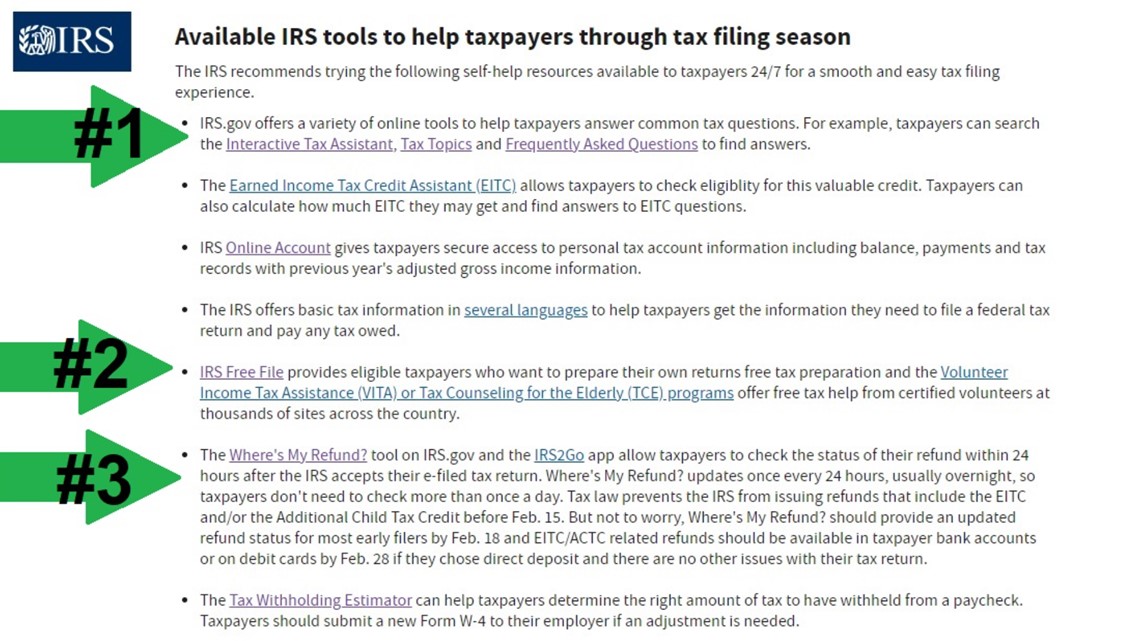

Want to learn more about how to simplify your taxes? Check out the IRS’s Tax Topics, which provide a wealth of information on various tax-related topics, including filing requirements and due dates.

Stay tuned for our next installment, where we’ll explore [Insert topic here]. In the meantime, feel free to reach out with your own tax questions – we’re always here to help!

As we conclude this series of free answers to tax questions, it’s clear that simplifying tax season is all about gaining clarity and confidence.

Your Guide to Simplifying Tax Season: A Recap

We’ve covered some of the most pressing tax-related questions, providing you with actionable insights to avoid costly mistakes and maximize your financial benefits.

From understanding what constitutes a qualified business expense to maximizing deductions for charitable donations, we’ve demystified the complexities of tax season. By arming yourself with knowledge, you can rest assured that you’re making informed decisions about your finances.

So, what’s the takeaway from this series? It’s simple: taking control of your taxes is within reach. By staying informed and seeking guidance when needed, you can simplify tax season and enjoy a smoother financial journey.

Your Next Step

As you prepare to tackle tax season with confidence, remember that it’s just the beginning. Stay ahead of the game by regularly checking our blog for new updates, tips, and insights on all things taxes.

We’re committed to providing you with the best resources available, ensuring you’re always one step ahead of the tax season curve. Whether you’re a seasoned pro or just starting out, we’ve got your back.

Balanitis vs Herpes: A Picture Comparison of Penis Issues: Do you have concerns about balanitis or herpes? This article provides a visual guide to help you identify the signs and symptoms of these common penis issues. Learn how to differentiate between the two conditions and take the first step towards getting the right treatment.

Read the Case Study: McRoy Aerospace on Page 332 and Answer Questions 4 and 5 on Page 333: Are you interested in learning more about the latest developments in aerospace engineering? This article provides a unique opportunity to delve into a real-world case study. Challenge yourself by reading the study and answering the questions to deepen your understanding of this fascinating field.